The Company

TonnEdge is a shipping investment technology and analytics company that aims to map standard best practices in financial analytics, risk and investment management to those of the ‘instinct’ driven commercial shipping markets’.

By doing so, we seek to empower both shipping players looking for an edge, and financial investors looking to diversify, with the requisite tools necessary for efficient vessel level financial risk and investment management.

TonnEdge prices the entire global fleet of traded commercial vessels, and is the exclusive supplier of vessel price data to commodity incumbent Refinitiv.

Our systematic vessel pricing process, and associated pricing history has been designed by both industry leaders and practitioners, using a combination of market inputs, quantitative methods and dynamically weighted offsets.

The Company

TonnEdge is a shipping investment technology and analytics company that aims to map standard best practices in financial analytics, risk and investment management to those of the ‘instinct’ driven commercial shipping markets’.

By doing so, we seek to empower both shipping players looking for an edge, and financial investors looking to diversify, with the requisite tools necessary for efficient vessel level financial risk and investment management.

TonnEdge prices the entire global fleet of traded commercial vessels, and is the exclusive supplier of vessel price data to commodity incumbent Refinitiv.

Our systematic vessel pricing process, and associated pricing history has been designed by both industry leaders and practitioners, using a combination of market inputs, quantitative methods and dynamically weighted offsets.

Introducing the first fully integrated risk and investment platform dedicated to shipping, endorsed by mainstream commodity and shipping data incumbents

Introducing the first fully integrated

risk and investment platform dedicated to shipping,

endorsed by mainstream commodity and shipping data incumbents

The Team

The team is comprised of a group of industry specialists from financial risk and investment management, shipping academia, ship management, ship brokerage – both physical and derivatives, commodities trading, analytics and shipping finance.

Numerous players across the shipping, financial risk and investment management communities have contributed to this initiative. Each with the clear understanding that the shipping industry must employ financial risk and investment management discipline in order to attract permanent, institutional grade public and private capital.

The Team

The team is comprised of a group of industry specialists from financial risk and investment management, shipping academia, ship management, ship brokerage – both physical and derivatives, commodities trading, analytics and shipping finance.

Numerous players across the shipping, financial risk and investment management communities have contributed to this initiative. Each with the clear understanding that the shipping industry must employ financial risk and investment management discipline in order to attract permanent, institutional grade public and private capital.

The Services

A wide range of services are available via TonnEdge’s Flagship

Suite of Modules, TonnEdge Accelerator

The Modules

Real Time Vessel

Pricing

Daily pricing of the Global fleet of traded vessels using a combination of market and quantitative factors.

Vessel Valuation

Certificates

Suitable for bank collateral assessment, and available within 12 hours

Supply & Demand

Analysis

Using granular / monthly tonne-mile and vessel supply development data to build a dynamic picture of the demand and supply trends in the industry.

The

Complete

Solution

Vessel Portfolio

Risk & Investment

Management

Combining parts of each module, together with portfolio insurance strategies to hedge financial risk, whilst targeting specific returns through vessel selection, capital structure choice and commercial strategy management.

Price & Earnings

Analytics

Using financial market methods to asses ship prices and earnings on both a cross-sectional and an historic basis. This will include shipping sentiment monitors.

Risk Management

Module

Ideal for both banks and shipowners to monitor their long and short shipping credit exposure based on market trends and scenarios.

Shipping

Indices

Capture exposures to various areas of the shipping market. Useful for risk management, exposure to pure shipping volatility, or as macro inputs for analysts.

The Services

A wide range of services are available via TonnEdge’s Flagship Suite of Modules, TonnEdge Accelerator

The

Complete

Solution

Vessel Portfolio

Risk & Investment

Management

Combining parts of each module, together with portfolio insurance strategies to hedge financial risk, whilst targeting specific returns through vessel selection, capital structure choice and commercial strategy management.

The Modules

Supply & Demand

Analysis

Using granular / monthly tonne-mile and vessel supply development data to build a dynamic picture of the demand and supply trends in the industry.

Risk Management

Module

Ideal for both banks and shipowners to monitor their long and short shipping credit exposure based on market trends and scenarios.

Vessel Valuation Certificates

Suitable for bank collateral assessment, and available within 12 hours

Real Time Vessel

Pricing

Daily pricing of the Global fleet of traded vessels using a combination of market and quantitative factors.

Price & Earnings

Analytics

Using financial market methods to asses ship prices and earnings on both a cross-sectional and an historic basis. This will include shipping sentiment monitors.

Shipping

Indices

Capture exposures to various areas of the shipping market. Useful for risk management, exposure to pure shipping volatility, or as macro inputs for analysts.

The Platforms

The routes to shipping market understanding

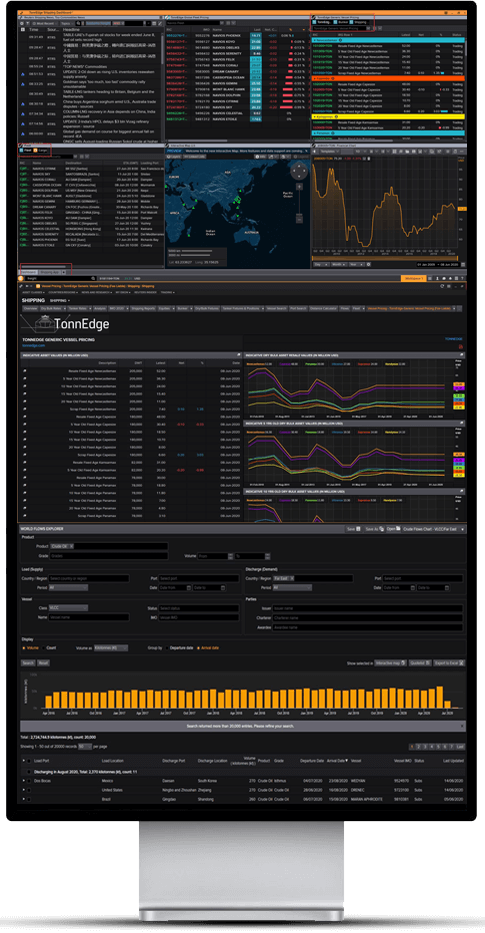

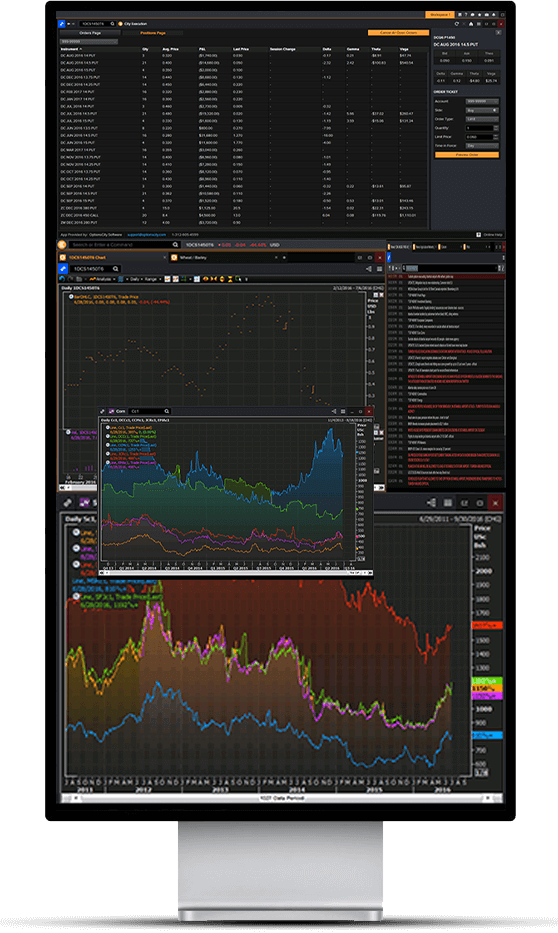

TonnEdge Accelerator

TonnEdge Accelerator is a suite of modules available to TonnEdge premium subscribers that enables users to monitor vessel and freight dynamics across the demand and supply side, whilst managing shipping risks and investments using financial market techniques adapted to the nuances of the shipping markets. It also provides tutorials and training modules that help users utilise each of the tools, with background information and related research.

TonnEdge and Refinitiv have collaborated on a number of these modules, and subscribers to both TonnEdge via Refinitiv and TonnEdge Accelerator will cover the full spectrum of shipping and commodity analytics, risk and investment management.

TonnEdge Accelerator

TonnEdge Accelerator is a suite of modules available to TonnEdge premium subscribers that enables users to monitor vessel and freight dynamics across the demand and supply side, whilst managing shipping risks and investments using financial market techniques adapted to the nuances of the shipping markets. It also provides tutorials and training modules that help users utilise each of the tools, with background information and related research.

TonnEdge and Refinitiv have collaborated on a number of these modules, and subscribers to both TonnEdge via Refinitiv and TonnEdge Accelerator will cover the full spectrum of shipping and commodity analytics, risk and investment management.

TonnEdge via Refinitiv

In the fast-moving commodities markets, having the knowledge, intelligence, insight and analysis to act swiftly is one thing. Being able to trust this information is another. That’s why traders, brokers, analysts, supply chain and procurement managers around the globe trust Refinitiv.

TonnEdge data and analytics are exclusively available through subscriptions to Refinitiv platforms, Eikon and Datascope Select and TonnEdge Accelerator.

Eikon is the financial analysis desktop and mobile solution that connects you to relevant, trusted content, Reuters news, markets, liquidity pools, and colleagues.

DataScope Select is a strategic data delivery platform for non-streaming content.

The powerful combination of TonnEdge vessel pricing and stylized shipping benchmarks with the vast array of Refinitiv shipping and financial data, analytics, commercial intelligence and news seeks to bring shipping market players to the forefront of shipping analysis 2.0.

TonnEdge via Refinitiv

In the fast-moving commodities markets, having the knowledge, intelligence, insight and analysis to act swiftly is one thing. Being able to trust this information is another. That’s why traders, brokers, analysts, supply chain and procurement managers around the globe trust Refinitiv.

TonnEdge data and analytics are exclusively available through subscriptions to Refinitiv platforms, Eikon and Datascope Select and TonnEdge Accelerator.

Eikon is the financial analysis desktop and mobile solution that connects you to relevant, trusted content, Reuters news, markets, liquidity pools, and colleagues.

DataScope Select is a strategic data delivery platform for non-streaming content.

The powerful combination of TonnEdge vessel pricing and stylized shipping benchmarks with the vast array of Refinitiv shipping and financial data, analytics, commercial intelligence and news seeks to bring shipping market players to the forefront of shipping analysis 2.0.

Get in touch

We welcome you to contact us for more information

about any of our services or request a live demonstration.

Get in touch

We welcome you to contact us for more information

about any of our services or request a live demonstration.